Reauthorization of the Regional Center program and clarity on minimum investment requirements may have been the most discussed aspects of the EB-5 Reform and Integrity Act at the time of its enactment.

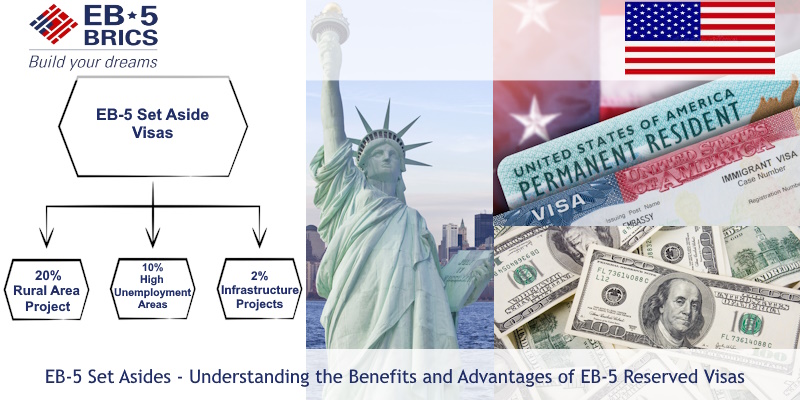

However, the introduction of reserved or set aside visas is a significant change that has the potential to clear the path for US permanent residence for investors from high-demand and high-backlog countries like China, India, and Vietnam.

Reserved and Set Aside EB-5 Visas

Until the Reform and Integrity Act (RIA), the visa’s availability depended solely on the Priority Date or the date of submission of the investor’s I-526 petition. An investor with an earlier Priority Date will receive the visa earlier compared to an investor with a later date.

This was the rule irrespective of whether it was a direct investment, an RC investment in a non-TEA project, or a TEA investment. This meant an investment in a luxury condo in a high-end locality was treated at par with a more productive project in a high-unemployment TEA.

The RIA sought to correct this by reserving visas for those choosing to invest in specific categories. Around one-third of all the visas available in a fiscal year will now be reserved or set aside.

10,000 visas allocated for the fiscal year

| Set Asides | % of total visas | No. of visas |

|---|---|---|

| Projects in rural areas | 20% | 2000 |

| Projects in high unemployment areas | 10% | 1000 |

| Infrastructure projects | 2% | 200 |

| Unreserved | 68% | 6800 |

This change means that an investor investing in an RC project or making a direct investment in a rural area will have a separate pool of EB-5 visas to qualify for the US green card.

The EB-5 program allocates around 10,000 visas in a year with a per-country cap of 7% or 700 visas. Before the RIA, these 700 visas would be allocated on a first-come first-serve basis irrespective of the type of investment deployed by the EB-5 investors.

Let us consider an example where 900 EB-5 petitions have been filed by the citizens of Sri Lanka.

Before RIA

| No. of visas | |

|---|---|

| Available visas | 700 |

| I-526 petitions | 900 |

| Backlog | 200 |

This exceeds the per-country cap of 700 visas, which means 200 applicants will have to wait. Before the RIA, the investor’s Priority Date would be the sole factor determining who gets the visa. The first 700 investors would qualify for the visas while the 200 investors with a later Priority Date will have to wait.

Impact of Reserved/ Set Aside Visas

| Total | Unreserved (68%) | Rural TEA (20%) | High Unemployment TEA (10%) | Infrastructure Projects | |

|---|---|---|---|---|---|

| Available visas | 700 | 476 | 140 | 70 | 14 |

| I-526 petition | 900 | 690 | 140 | 70 | 0 |

| Backlog | 214 | 0 | 0 | 0 |

The RIA changes how these visas will be allocated and which category of investors will have to wait for additional visas to become available.

Even if the 140+70=210 TEA investors have a later priority date, the set asides ensure they will still get the visa. Those in the unreserved category will have to wait either for visas unused by other countries to become available or for the next fiscal year for fresh visas to be issued.

Rural TEAs

For a project to qualify as a rural TEA, the following conditions must be fulfilled.

- The location’s population should not be greater than 20,000

- It must not border a municipality with more than 20,000 people.

- The project must be located outside metropolitan statistical areas (MSAs).

Rural TEAs set asides are very attractive because the highest percentage of visas are reserved for this category. Further, there are no unemployment requirements for Rural TEA Projects, which gives investors a wider choice of projects to qualify for the reserved visa.

High-Unemployment TEAs

The definition of a high-unemployment TEA remains unchanged. The area’s unemployment rate must be at least 150% of the national average or higher. This is a more familiar option for investors although there are greater chances of this set aside being used up very quickly.

Infrastructure Projects

These cover government-sponsored projects and may include privately funded projects too. This is a completely new investment option with comparatively very few visas set aside.

Concurrent Filing and Set Asides—Double the Good News

Along with introducing set asides, the RIA has also allowed EB-5 investors to concurrently file their I-485 along with the I-526 petition. The latter is the EB-5 visa petition while the former is filed towards the end of the period of two-year conditional permanent residence.

The biggest advantage of concurrent filing is that the petitioner enjoys virtually all the benefits and privileges of permanent residence pending the adjudication of the petition.

The RIA permits concurrent filing only if the visa is available at the time of the I-526 petition as well as at the time of adjudication. Countries like China, India, and Vietnam are facing long backlogs in the unreserved category, which means these investors cannot take advantage of the benefits of concurrent filing.

The set asides are current for all countries, which means an investor choosing to apply for the reserved visa will—for all practical purposes—become a permanent resident upon approval of the I-526 and commencement of the two-year conditional permanent residence.

Impact on Repayment Period

EB-5 rules pre-RIA require the investment to be held at risk through the two years of conditional permanent residence.

This becomes a problem when there is a significant gap between I-526 approval and the availability of the EB-5 visa. Set asides virtually eliminate this issue by allowing investors to sidestep the issue of visa unavailability.

This means the at-risk requirement can be fulfilled faster and the investor will qualify for quicker repayment of the investment by the Regional Center project.

On October 11, 2023, USCIS released an updated guidance on the revised EB5 investment timelines under the RIA. You will only need to maintain your investment for just two years beginning on the date of your investment in a new commercial enterprise to qualify for an EB5 visa.

Effect on EB-5 Visa Processing and Wait Times

Applying for the EB-5 Reserved Visa category significantly shortens the processing and wait times for immigrant investors, especially those from high-demand countries. The RIA implemented priority processing of I-526/I-526E petitions for rural, high-unemployment, and infrastructure project investors for faster EB-5 Visa Processing and Wait Times. Expedited processing reduces the approval of your I-526/I-526E to 12 months from the average EB5 processing time of 29 months.

Carryover of Unused Reserved Visas

Unused EB-5 Reserved Visas are carried over to the next fiscal year which begins every October 1 and ends on September 30 of the next fiscal year. These unused set aside visas are then added to the total number of newly available EB5 visas for each fiscal year. The carryover of unused reserved visas allows for more visa numbers to be available under the EB 5 set aside category.

Set Asides—Overall Positive

The absence of a per-country cap in the set asides would have been even more beneficial for EB-5 investors. Despite this, the introduction of set asides or reserved visas is a significant positive.

Of course, investments in rural or high-unemployment projects have their unique risks and challenges. Investors must rely on professional guidance covering both reserved and unreserved project investments before beginning their EB-5 journey.