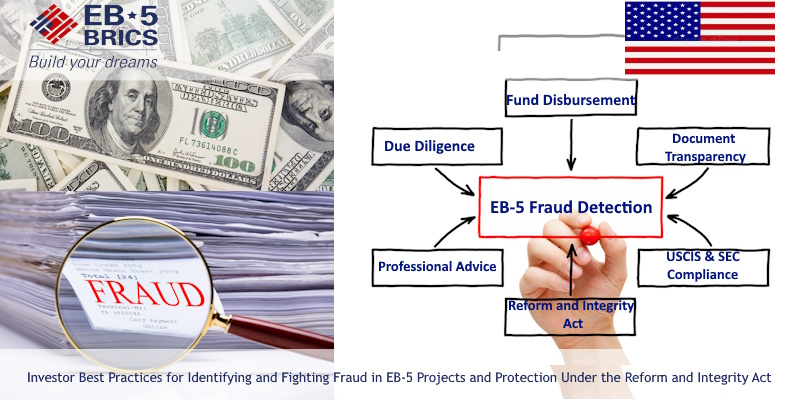

Identifying and preventing fraud in EB-5 Projects is a shared responsibility of the U.S. agencies involved in administering the Immigrant Investor Program and all of its participants. The identification and prevention of EB-5 fraud involves conducting extensive due diligence on regional centers, project developers, and all other entities involved in promoting the investment. As an investor, you will need the help of the right experts and professionals to thoroughly evaluate EB5 Project documents, funding disbursements, and management. In our guide, you’ll find the best practices you need to engage in as an immigrant investor to decide on an EB 5 Visa Project to invest in.

The 2022 Reform and Integrity Act (RIA) also implemented enhanced provisions to protect you from EB 5 fraud so you can invest in your U.S. Green Card with more confidence. These provisions include stricter requirements for all EB5-affiliated entities as well as the approval of all proposed new commercial enterprise (NCE) projects. The U.S. Citizenship and Immigration Services (USCIS) commits itself to monitoring the compliance of all EB-5 Program participants to detect and mitigate fraud while shielding good faith investors who fall victim to fraudulent activities. Through our due diligence process, we’ve already helped hundreds of investors obtain EB5 petition approvals and our article will further guide you in your decision-making for your Green Card investment.

How to Identify and Prevent Fraud in EB-5 Projects?

Identifying and preventing fraud in EB-5 Project investments entails conducting due diligence with the help of professionals who are experienced in the US Immigrant Investor Visa Program. Fraud in EB-5 Projects exists in circumstances that involve document falsification, misrepresenting investment prospects, and squandering investor funding. The U.S. Government Accountability Office (GAO) found in its latest report on the EB-5 Program that the most common EB5 fraud cases have to do with gaining immigration benefits and defrauding good faith investors without their knowledge or participation. The Government Accountability Office (GAO) report on the EB-5 Program included recommendations such as the creation of a system that enables the U.S. Citizenship and Immigration Services (USCIS) to track and assess data to help detect cases of fraud in EB5 applications.

As an immigrant investor, you also need to take certain steps to identify fraudulent activities before investing to protect your financial and immigration interests. You need to make sure the project complies with the requirements of the EB 5 Program by thoroughly going over all project documentation and consulting with legal counsel. Additionally, you need to be well-versed in the key warning signs for EB 5 fraud and the existing regulations from the Securities and Exchange Commission (SEC) and the U.S. Citizenship and Immigration Services (USCIS) for monitoring and increasing transparency in the EB-5 Visa Program. Beware of projects that guarantee investment returns with little to no risk in exchange for a US Green Card as these are classic warning signs for fraud. The EB-5 Visa USA Program does not ensure your permanent residency based on making an investment alone. The capital you invest must be at-risk in such a way that it is injected into the U.S. economy for the purpose of creating jobs.

Educating yourself on how to fight EB-5 fraud is a highly important task that must be done before you even start the application process. We’ll take you through the actions that you can do to safely invest in an EB-5 Visa Project.

What are the Best Practices for Identifying Fraud and Fighting Fraud for EB-5 Investors?

Here are the best practices that you can engage in as an investor for detecting and fighting the prevalence of fraud in EB5 Visa Projects. We’ve already helped numerous investors gain EB-5 petition approvals through our due diligence on investment projects and regional centers.

Engage in Thorough Due Diligence of the Project’s Affiliated Entities

You should be comfortable with the integrity of all parties participating in the EB5 Project, especially in the management and distribution of funds, before signing any agreements. Your EB-5 Due Diligence would necessitate independent verification of the entity’s credentials, experience, and legal standing.

You can also visit the EB 5 Project’s location to conduct an in-person investigation. Reputable projects will make this kind of investigation easier and will be happy to reassure you by conducting a webcam tour of the site in real-time to save you on travel expenses. You can also do sporadic web searches for details about the project and any parties involved to stay up to date on any news related to the proposed investment.

Pay Close Attention to Fund Disbursement

The project’s disbursement agreement should specify exactly how capital will be spent during the planning, building, and operating phases of the project. Each party involved in a project must confirm and approve all expenses made in accordance with this agreement. You need to review the project documents related to fund disbursement since you will need this when you’re about to file Form I-829 (Petition by Investor to Remove Conditions on Permanent Resident Status) to remove the conditions on your EB 5 Green Card. You will have to demonstrate in your I-829 evidence that the funds have been used in accordance with EB-5 regulations and in accordance with the supporting documentation for your Form I-526 (Immigrant Petition by Standalone Investor)/Form I-526E (Immigrant Petition by Regional Center Investor). The financial evidence you need to present includes bank statements, salary records, and other receipts, to track the EB 5 money from escrow to the creation of jobs.

Generally, in most EB-5 Projects, the new commercial enterprise (NCE) gathers the capital and disburses it to the job-creating entity (JCE). Regional centers usually take care to collaborate with seasoned fund managers who have a solid reputation in the business to ensure that there is no misappropriation of EB 5 funds and that the project is set up in a way that discourages fraud. Still, it’s best practice for you to verify the backgrounds of all individuals having access to the investment funds, the relationship between the new commercial enterprise (NCE) and the job-creating entity (JCE), and all financial documentation.

Find Out How the Developers or Sponsors of the Project Will Be Paid

In addition to EB 5 capital allocation, make sure you comprehend the terms of the compensation of the project developers or sponsors, especially if these entities are not investing in the project themselves. In situations where there are no personal investments made by developers, it may suggest that their financial incentives are unrelated to the performance and profitability of the project in the end. Inquire about the investment’s structure and its affiliates. Conflicts of interest that need to be declared and assessed may arise if the same people oversee multiple tiers of entities. Any discrepancies between the information in the offering materials and the responses you receive should raise red flags.

Get Everything in Writing

A business plan and offering paperwork, such as a private placement memorandum (PPM), detailing the suggested terms of the investment should be provided by the sponsor of an EB 5 Visa investment. Do not proceed with the investment if you’re unable to obtain these documents. Once you’ve gotten the necessary paperwork, confirm whether the claims of the project developer are true and consistent with the offering documents and in their USCIS filings. For example, in real estate EB-5 Projects, planning or zoning authorities must grant permits and permissions for these developments. Get in touch with these organizations and request information or documentation to confirm that these permissions or approvals have been secured.

Obtain Advice and Reviews from Third Parties

Finally, to protect your investment from EB-5 fraud, you should collaborate with knowledgeable experts in the field. While regional centers will typically engage an accountant to assess the fund manager’s performance, EB 5 investors should make sure the accountant is not connected to the project owners and is employed by a separate company. Should the project have obtained any federal, state, or municipal funding, such as grants or tax credits, those authorities will probably carry out independent audits of the project’s expenses to verify that all the money has been used as stated.

You also need the help of your EB5 attorney in order to perform due diligence and compile any paperwork required for the project and the EB-5 Program. An EB-5 Visa attorney is well-versed in the intricacies of the program providing insightful counsel during the I-526 and I-829 petition filing processes and helping you spot any indications of potential fraud by third parties.

How the Reform and Integrity Act Protects Investors from EB-5 Fraud?

The EB-5 Reform and Integrity Act (RIA) was passed by Congress in order to safeguard foreign investors and lower the risk of fraud. The Reform and Integrity Act (RIA), which became operative on March 15, 2022, brought about changes to increase the level of accountability between regional centers and EB-5 recipients to USCIS. USCIS will now closely monitor the operations of regional centers in accordance with the RIA. Fraud, fund mismanagement, and non-compliance will be even less likely with increased control. In addition, the EB-5 Integrity Fund contributions from each regional center will supply USCIS with more resources to monitor the EB-5 investment sector.

By implementing these changes, any EB 5 regional center will be deterred from abusing its affiliation and financing arrangements. The EB 5 RIA would also impose severe penalties on non-compliance, such as giving false information, in order to hold EB-5 industry participants accountable. As an immigrant investor, you’re better protected by these safeguards against losing your EB5 money or losing your eligibility for a USA Green Card.

The EB5 RIA not only affects regional centers, but everyone in the EB-5 market, from fund managers to foreign immigration agents, and mandates increased transparency. In the following sections, we’ll further discuss the mandates of the Reform and Integrity Act for combatting EB 5 fraud.

Revised Reporting Requirements

The EB-5 Reform and Integrity Act implemented new reporting forms to monitor regional center compliance as well as track all other entities participating in the US Investor Immigrant Visa Program.

Regional Centers

The management of regional centers must first notify USCIS before making any changes to the management team or business structure. Annual financial reports must be submitted by regional centers to both USCIS and their investors and must demonstrate the regional center’s compliance with the US securities laws. The new reporting obligation gives you access to annual reports that provide in-depth information about how your money is spent.

Third-party Fund Administrators

Since EB-5 commercial entities are now required to hire third-party fund administrators or acquire audited financial statements, the annual financial reports from regional centers must also be validated. This additional measure helps guarantee that the NCE uses the EB5 investment fund for employment creation. Furthermore, trustworthy fund administrators are unlikely to approve a dubious, high-risk, or non-compliant EB5 Project because they are frequently very selective about their clientele. Because of this, you’ll be able to rest easier knowing that the project you invested in will manage your investment properly and more transparently.

Material Changes

One of the biggest immigration risks for you as an EB-5 investor is the potential for material changes to the EB-5 Project you invested in. Material changes are substantial deviations from the business plan of an EB 5 Investment Project that might impede your eligibility for a Green Card. As a result of the RIA, regional centers must now inform USCIS of any major project modifications and whether or not they informed investors of these changes. Hence, there is more push for regional centers and project developers to go through with the business plans.

Promoters and Migration Agents

All promoters advertising an EB-5 Project are now required by law to register with USCIS. A list of all the fees paid by investors will even need to be provided by foreign migration agents. Previously, USCIS had little monitoring over foreign immigration agents employed outside of the USA. Before this requirement, it was simpler for EB-5 investment promoters to be less open and honest with investors since there was less monitoring from USCIS.

NCE Approval

Under the RIA, regional center investors will have to wait for USCIS to approve the NCE they’re investing in before they can submit their I-526E petitions. These EB 5 Project requirements contain information about the project’s marketing fees and operations strategy to show compliance with US securities legislation, in addition to investment documents related to the EB-5 Project, such as the private placement memorandum. USCIS will be able to keep a closer eye on regional center operations thanks to NCE pre-approval to detect early on any anomalies or non-compliance.

USCIS Actions and Penalties for Noncompliance

In order to prevent EB5 fraud and misappropriation of funds, USCIS will also physically inspect regional center developments. These inspections will aid in verifying that the stated commercial operations are, in fact, occurring. Additionally, every EB5 regional center will be audited by USCIS at least once every 5 years.

USCIS commits to conducting more extensive background checks on everyone working in the EB 5 sector. A person cannot be associated with a regional center if they have been convicted of a crime within the last 10 years. Additionally, participation in the EB5 regional center program is prohibited for anyone who has been involved in a fraud prosecution with a liability of more than $1 million.

Severe penalties will be imposed on regional centers that do not submit accurate reports or comply with the RIA’s new criteria. A non-compliant regional center may be fined by USCIS up to 10% of the capital they have raised. USCIS has the authority to disqualify any people implicated in non-compliance and to suspend or cancel regional center licenses.

Protections Against Regional Centers and EB-5 Projects That Are Terminated or Denied

An EB 5 Visa Project’s success is not guaranteed, even if you thoroughly assess the enterprise before investing. An EB-5 Project or regional center may be terminated or debarred as a consequence of fraud, poor management, or non-compliance on their part. Before the Reform and Integrity Act, investors whose EB-5 Projects or regional centers were rejected or terminated were almost certainly to have their US EB-5 Visa petitions denied by USCIS. The RIA contains provisions to shield you from uncontrollable circumstances in order to mitigate this risk. You now have 180 days to invest in other EB-5 Projects or to have your project affiliate with a new regional center in the event that your regional center or EB5 Project is terminated or debarred. By using this clause, innocent investors will not forfeit their USCIS processing priority dates or the ability to keep their dependent family members’ child status.

How Our Approach Works for EB-5 Investors

We perform extensive due diligence on investment projects for an EB5 Green Card to help our investors select the most suitable option that fits their needs and goals. We have already helped hundreds of immigrant investors like you achieve approvals on their immigrant petitions and Green Card applications. Set up a consultation with us to learn how you can immigrate permanently to the United States as an EB-5 Visa investor.