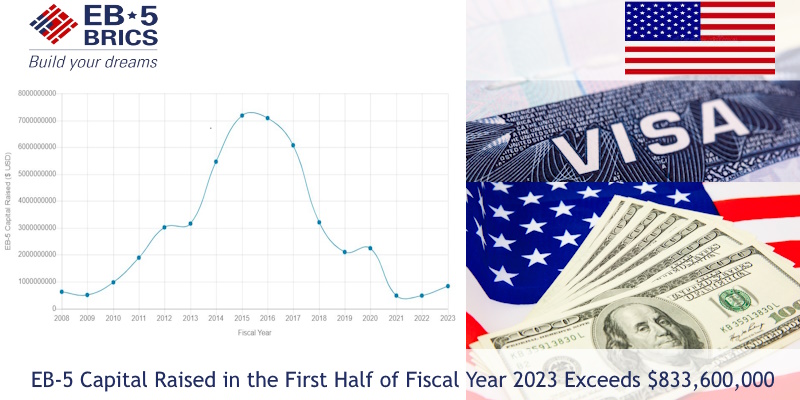

The EB-5 Visa Program has already raised over $833,600,000 USD in capital funding for commercial projects in the United States for the first half of fiscal year 2023. The EB5 capital raised from October 1, 2022, to March 31, 2023, comes from the 1,091 immigrant investors who submitted I-526/I-526E petitions for quarters 1 and 2 of the fiscal year 2023. EB 5 financing has reached $50.2 billion USD since the Immigrant Investor Program started in 1990 and has contributed substantially to US economic growth and created numerous jobs for Americans.

The current EB5 minimum investment amount is $800,000 USD for projects in rural areas and high-unemployment regions. The EB-5 Immigrant Investor Visa Program was postponed for several months between 2021 and 2022 and was reauthorized with new priority project categories aimed at encouraging foreign investments once again. The development of priority categories for infrastructure, high unemployment, and rural projects is what has led to the current surge of interest in the US EB5 Visa.

We have assisted numerous immigrant investors like you in getting a USA Green Card by investment. Continue reading to find out more about why EB 5 funding remains a sought-after source of commercial project financing and why you should consider investing in an EB 5 Visa.

How Many Investors Filed for an EB-5 Visa to Raise Over $833,600,000 in the First Half of Fiscal Year 2023?

A total of 1,091 immigrant investors filed EB-5 Visa petitions in the first half of fiscal year (FY) 2023 to raise more than $833,600,000 USD to fund new commercial enterprises (NCEs) in the United States. The EB5 capital accumulated for the first half of the fiscal year (FY) 2023 was based on the statistics released by the U.S. Citizenship and Immigration Services (USCIS) for EB5 immigrant petition filings from October 1, 2022, to March 31, 2023.

Foreign investors seeking a US Green Card for permanent residence must file Form I-526 (Immigrant Petition by Standalone Investor) or Form I-526E (Immigrant Petition by Regional Center Investor) to initiate the EB 5 Visa process. There were 556 EB-5 investors who filed I-526/I-526E petitions for quarter 1 of FY 2023 (October 1, 2022 to December 31, 2022) and 535 investors who filed I-526/I-526E petitions for quarter 2 of FY 2023 (January 1, 2023 to March 31, 2023). At least $833,600,000 USD have already been invested by EB5 Visa applicants into the U.S. economy based on the EB-5 Statistics for Quarter 1 of FY 2023 and EB-5 Statistics for Quarter 2 of FY 2023.

How Much Capital Has Been Invested Since the EB-5 Visa Program Started?

EB 5 financing has reached $50.2 billion USD since the Immigrant Investor Program started in 1990 based on I-526 data from Invest in the USA (IIUSA). The EB5 Visa Program was created to stimulate U.S. economic growth and generate jobs through foreign investment. In return, foreign EB-5 investors and their families obtain a USA Green Card and are granted the right to live and work permanently in the United States.

EB-5 Capital Raised from FY 2008 to FY 2023 (Q1-Q2)

Data from Invest in the USA (IIUSA) Form I-526 Data Dashboard

EB-5 funding is a preferable source of capital for real estate developers when compared to other financing choices, such as mezzanine financing. The interest rate on EB-5 financing is often lower, making it a desirable choice for developers trying to lower their borrowing expenses. Additionally, EB 5 funding allows for lengthier repayment options, with durations ranging from 5 to 7 years, than conventional funding sources. The burden on cash flow during the construction phase is lessened by the longer repayment period, which enables developers to postpone payments until the project is finished and bring in money.

EB-5 capital is a versatile alternative for financing that can be tailored to the requirements of certain projects. Developers are able to alter the financing’s parameters, including the interest rate, payback schedule, and collateral requirements to suit the needs of their particular projects.

How Much is the Minimum EB-5 Investment Amount for a US Green Card?

The required minimum EB5 investment amount for a US Green Card is $800,000 USD for projects located in Targeted Employment Areas (TEAs) such as rural or high-unemployment regions. An EB 5 investment in a non-Targeted Employment Area (n0n-TEA) should be at least $1.05 million USD.

Not only do TEA investments qualify you for a lower EB5 Investment Amount, but you are also eligible for priority processing of your I-526/I-526E petition and reserved visas if you invest in a high-unemployment or rural area project.

What are the Best EB-5 Projects to Invest in?

Most EB-5 Projects that are best to invest in are found in real estate ventures, which can be anything from office buildings to housing construction. A percentage of the project expenditures for real estate developers are frequently covered by EB 5 capital, with the balance typically being raised through conventional financing channels such as bank loans, private equity, and mezzanine financing. Your options for the Best EB5 Investment Projects to invest in include the hotel construction, restaurant, and biotechnology industries where the market demand is consistent, EB 5 jobs are easily created, and investor repayment is more secure.

The EB-5 Immigrant Investor Visa Program was postponed for several months between 2021 and 2022 while Congress worked out program adjustments and enhancements to boost investor trust and fight fraud. Congress also established new priority project categories as a result, to encourage investors from nations like China and India to participate in the EB 5 Program. The development of priority categories for infrastructure, TEA, and rural projects is what has led to the current surge of interest in the US EB5 Visa.

How EB5 BRICS Helps You Get Your US Green Card by Investment

EB5 BRICS helps immigrant investors like you acquire a USA Green Card through the EB-5 Visa Program. We conduct due diligence to assist you in choosing the best EB5 Project to invest in. We have helped numerous foreign investors navigate investing and immigration in the United States by working with immigration attorneys, regional centers, and financial advisors. Schedule a consultation with us for more information on EB-5 investment projects and start your US immigration journey today.